Urban Connect Home Loan

Enjoy an urban, inner-city lifestyle with our Urban Connect Home Loan. We offer low entry costs, with a low deposit requirement and no lender's mortgage insurance. Learn more and apply today.

Start living your urban lifestyle sooner with our Urban Connect Home Loan.

Loan features:

- Available for medium and high-density apartments (now available for one-bedroom apartments), giving you more choice in where you live and what you can buy.

- Deposit as low as 2%.

- No lender's mortgage insurance.

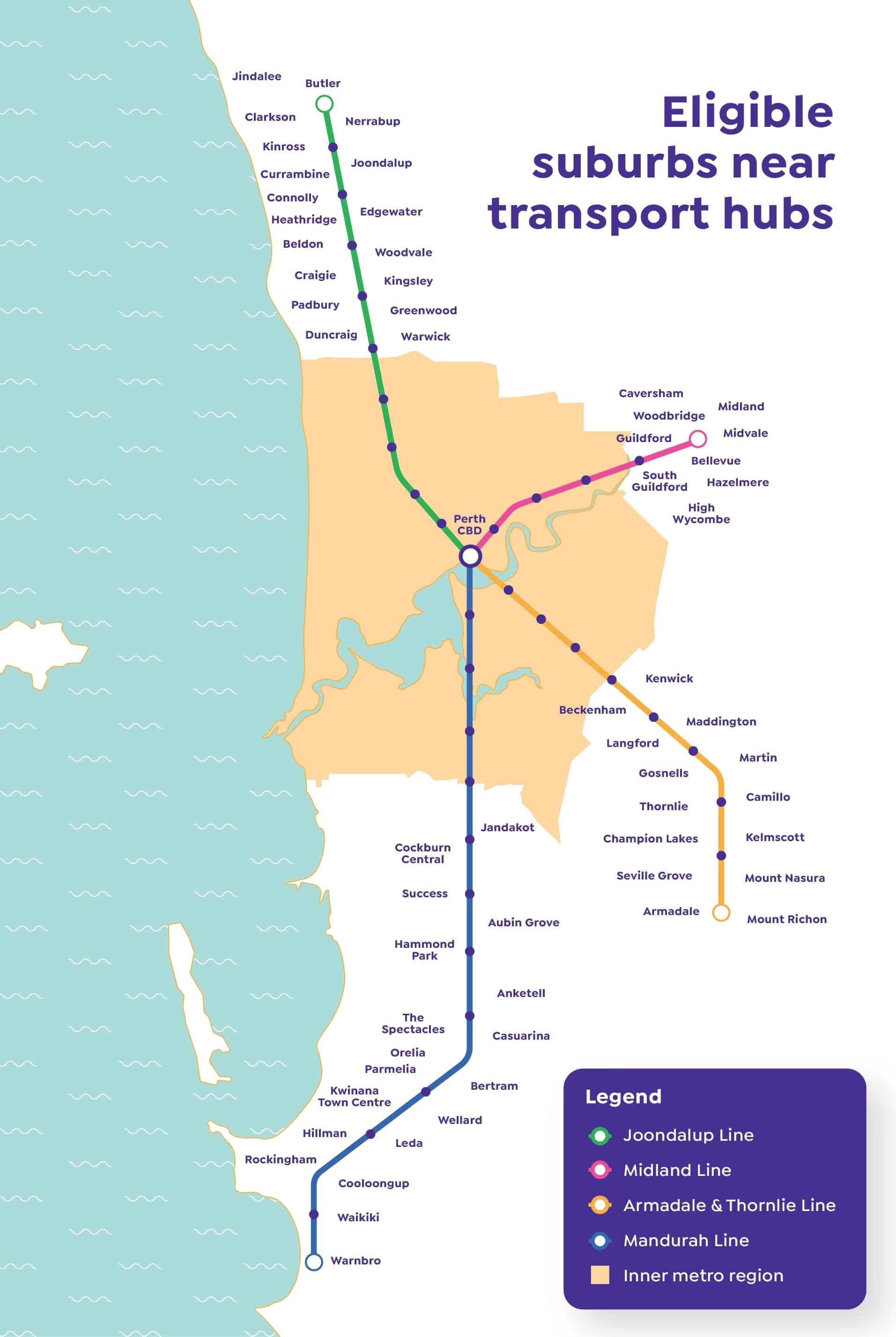

- Urban locations and close to rail transport hubs.

- For singles, couples and families.

- For owner-occupiers only, meaning you need to live in your home during the life of your Keystart loan, not rent it out. This loan product is not available for investors.

Related loan product:

- Funding for off-the-plan apartment deposits with Urban Connect Plus.

Urban lifestyle. Apartment living.

Urban Connect is only available for the purchase of an apartment.

Considering an off-the-plan apartment?

If you're interested in an off-the-plan apartment (meaning it hasn't been built yet), you may be interested in Urban Connect Plus. Urban Connect Plus is a specifically designed loan to cover the developer's deposit for an off-the-plan apartment if you don't have the funds available upfront.

If you purchase a new apartment, you may be eligible for either a stamp duty concession or rebate.

Transport hubs and station precincts

Urban Connect Home Loan is available in suburbs close to selected rail transport hubs. Live close to public transport and enjoy an urban lifestyle, with a connection to your city within walking distance.

Want to live in the inner metro area?

Looking to stay central? There are a lot of great reasons to live in Perth's inner city. Access to great facilities and close to the city for work or play the choice is yours!

Rates and fees

Loan repayment amounts

Loan repayment amounts shown are based on a simplified amortised schedule of repayments model. Actual loan repayments are subject to various internal and external factors including (but not limited to) changes in interest rates, fees and taxes. In particular, the model cannot predict future interest rates and therefore assumes the current variable rate for the remainder of the loan period.

Comparison rate

Warning: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Deposit required

Your deposit will be the higher of 2% or $2,000. The deposit required shown here may vary dependent on location and purchase price.

Purpose of the home loan

Not all loan products allow you to build a home.

Borrowing amount

This amount is provided for illustrative purposes only. The amount you may be eligible to borrow will be based on a full application. All applications for loans are subject to Keystart's standard credit policies and loan approval criteria, and depend on the particular circumstances and credit attributes of each applicant. Actual loan amounts approved may therefore be different to the results presented.

Loan increases?

Income limits

Five simple steps to home ownership

Getting your own home is an exciting time and will take you on quite a journey.

-

Get in touch

Find out if you qualify (we call this pre-qualification) in 5 minutes. The Urban Connect Home Loan is a little different, so you'll need to give us a call on 1300 578 278 to check your eligibility.

If you're eligible and choose to start an application with us, it will take approximately 25-30 minutes.

-

Conditional approval

Now find out how much you can borrow - so you'll know how much you can afford before you put in an offer. -

Formal loan approval

So, you've made an offer on a property. Exciting times! To move to formal approval you'll need to meet any outstanding conditional approval conditions. Then we'll send you documents to sign.

-

Settlement

Keystart's settlement agent will liaise with your settlement agent to organise settlement.

Once settlement has occurred you can move into your new home!

-

Manage your loan

We aim to support you through your home loan journey. The application process is just the beginning. Now you will begin to manage your home loan.

Get started!

Enter your details below to find out if you may be eligible for the Urban Connect Home Loan. One of our home loan specialists will be in touch to do an assessment over the phone with you.

You can also give us a call on 1300 578 278 to find out more.

You can view all our loan products here.

Q&A's about this loan

-

Q

Why is the loan only available for apartments?

A

Urban Connect Home Loan is designed to support the Western Australian Government's urban infill priority. Currently, this loan is available for apartments only.

-

Q

Are suburbs near METRONET precincts eligible for Urban Connect Home Loan?

AUrban Connect is currently available for suburbs in the inner metro areas or near selected rail transport hubs. It is not currently available for areas around METRONET Phase 1 stations.

Try our two new financial wellbeing quizzes

Get a big-picture look at your wellbeing or find out how your attitudes and beliefs impact your financial behavior.