Urban lifestyle. Apartment living.

Urban Connect is only available for the purchase of an apartment.

Considering an off-the-plan apartment?

If you're interested in an off-the-plan apartment (meaning it hasn't been built yet), you may be interested in Urban Connect Plus. Urban Connect Plus is a specifically designed loan to cover the developer's deposit for an off-the-plan apartment if you

don't have the funds available upfront.

More about Urban Connect Plus

If you purchase a new apartment, you may be eligible for either a stamp duty concession or rebate.

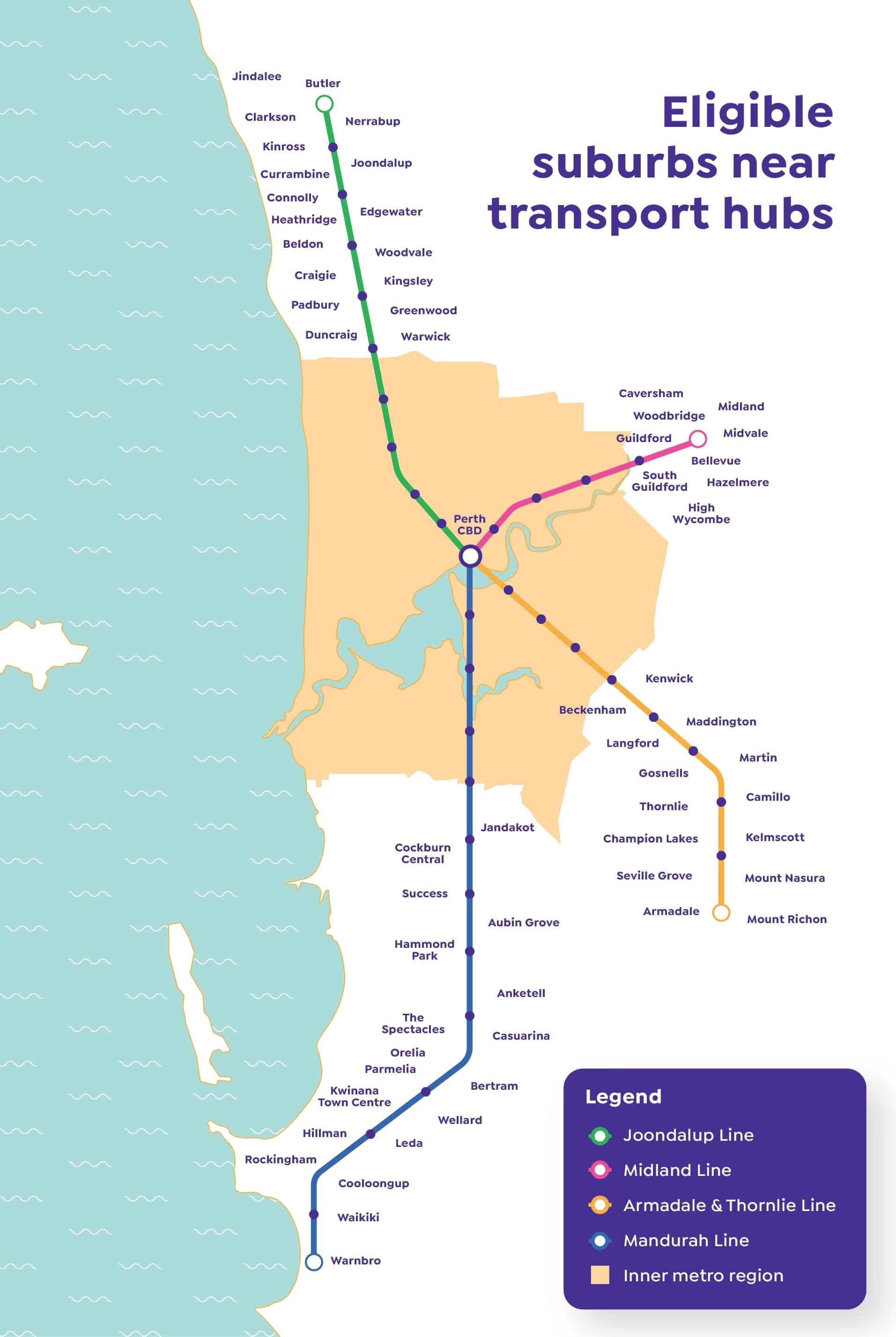

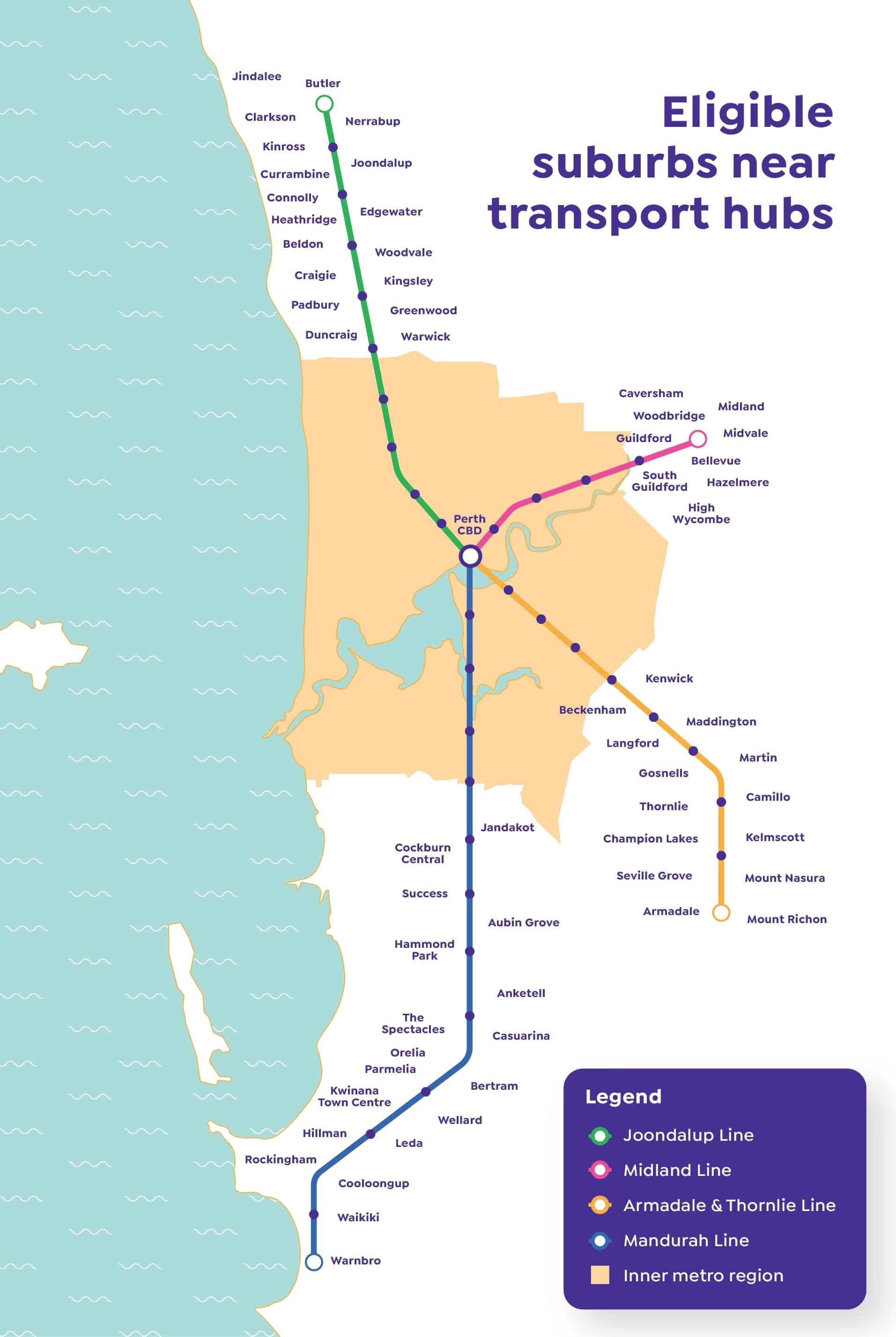

Transport hubs and station precincts

Urban Connect Home Loan is available in suburbs close to selected rail transport hubs. Live close to public transport and enjoy an urban lifestyle, with a connection to your city within walking distance.

Want to live in the inner metro area?

Looking to stay central? There are a lot of great reasons to live in Perth's inner city. Access to great facilities and close to the city for work or play the choice is yours!