Shared Ownership Home Loans

Good news! We've extended our new Urban Connect Shared Equity Home Loan product to the broker network to help make affordable home ownership a reality for more Western Australians.

What is a shared ownership loan?

A shared ownership home loan is designed to help more people reach their dream of owning a home in an affordable way. The Housing Authority will contribute a share in the property and acts as a silent partner, reducing the amount your customer needs to get started. The share amount varies depending on the customer's circumstances. Keystart will then provide a loan for the customer's share in the property, resulting in lower repayments compared to purchasing the whole property outright.

Maximum limits apply to the customer's income to be eligible for a shared ownership home loan. There is also a maximum share that the Housing Authority will co-own.

Urban Connect Shared Equity Home Loan

Urban Connect Shared Equity helps your customers to purchase a home sooner by bridging the gap between what they can afford to borrow and the price of a home that suits their needs. Similar to the Shared Ownership Home Loan, the Housing Authority will contribute up to a maximum of 35% of the purchase price or a maximum of $250,000, depending on the customer's circumstances.

View income limits and property price limits

Customers can choose to increase their ownership share of the property, and they can refinance or sell whenever they wish. By purchasing more shares, Housing Authority's share of the property is reduced, helping them move closer to owning 100% of their home.

There're no rent inspections. The Housing Authority does not conduct inspections on its shared ownership properties. As long as customers maintain the property and meet their obligations under the mortgage and co-owners deed, they can enjoy the property without disturbance.

As the home is theirs to enjoy, customers can make improvements to their home. However, any structural changes will require approval from Housing Authority and purchases over $5,000 will require proof of receipts.

Loan features

- Available for individual, multiple or grouped dwellings, including apartments, townhouses, units, and villas which are newly built, under construction or off-the-plan anywhere in Western Australia. Properties can be single or multi-storey, built or survey strata, or on a green title with a maximum land size of up to 200 square metres.

- Low 2% deposit.

- No lender's mortgage insurance.

- Shared ownership.

- First home buyers who qualify for First Home Owner Grant can also use it towards their deposit and associated fees.

Resources for your customers

The following resources will help your customers understand all about shared ownership and the processes involved when they decide to move on from Keystart.

- All about shared ownership.

- Refinancing your shared ownership home loan.

- Selling your shared ownership home.

- Selling your shared ownership home if you have a fixed shared ownership home loan.

Q&As about this loan

-

Q

Can my customer purchase an established property?

A

No, the property needs to be a house/land package, off-the-plan or newly built property.

-

Q

How should the contract of sale be prepared?

A

Refer to the example included in the customer’s conditional approval letter.

-

Q

Is the interest rate the same as Keystart’s Low Deposit Home Loan?

ASkilled Start Home Loan interest rate offers a discount on Keystart’s standard variable interest rate.

-

Q

Are customers able to choose their percentage of property ownership?

ANo, the ownership percentage is determined by the customer’s financial situation and borrowing capacity. We recommend advising your customer to wait for conditional approval before signing any contracts.

-

Q

Is there any flexibility with the land size exceeding 200 square metres?

A

No, the land size must be under 200 square metres.

-

Q

What if my customer exceeds the income or property purchase price caps?

A

Depending on how far over the threshold your customer is, the application may still be considered; however, outside policy approval will be required. The Housing Authority contribution cannot exceed 35% or $250,000. If you’re unsure, email scenario@keystart.com.au or contact your Broker Relationship team.

-

Q

Do applicants need to be Australian citizens?

A

Customers need to be either an Australian citizen or hold permanent residency visa. The only temporary visas we accept are:

- subclass 444 visas for New Zealand citizens, and

- spousal visas 309 or 820, provided they are within the two-year waiting period for permanent residency (calculated from the Visa Grant Notice date).

-

Q

Is the liquid asset policy the same as other Keystart home loans?

A

No, the liquid asset limit for Urban Connect Shared Equity is $25,000. This is lower than our standard liquid asset policy because the Housing Authority may contribute up to $250,000 toward the purchase. Customers are expected to maximise their contribution to the property as well.

-

Q

How can I calculate the customer's percentage ownership share?

A

The customer’s ownership percentage is determined by their financial situation and maximum borrowing capacity. To estimate this, complete the scenario in the offline calculator and then click on the UCSE tab at the bottom.

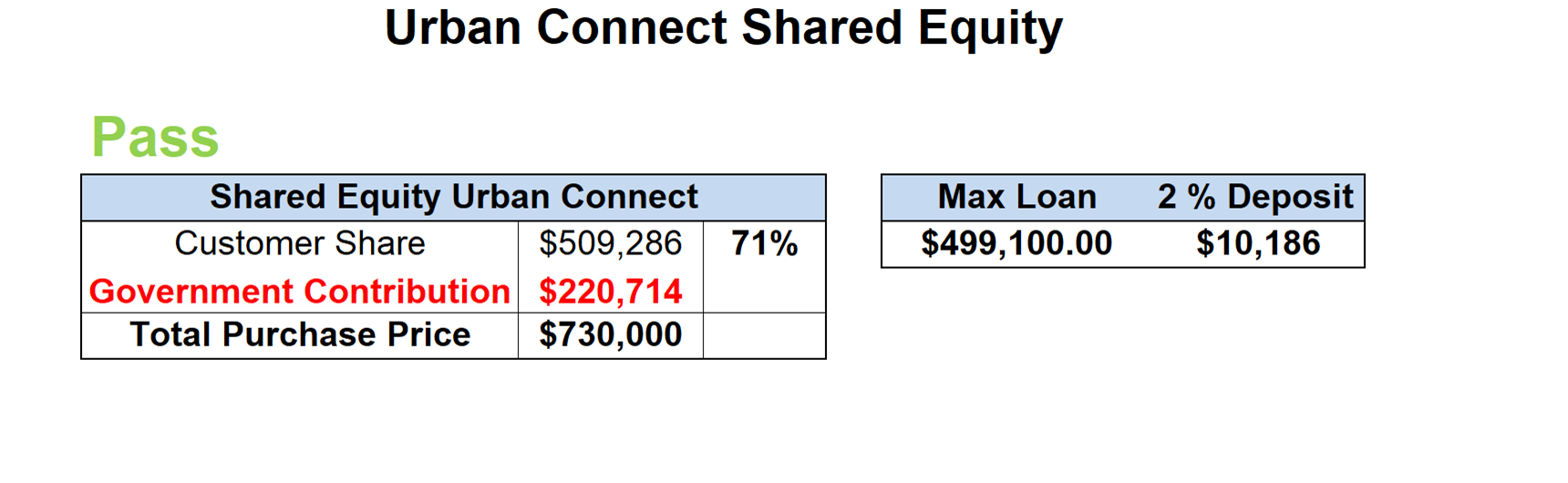

For example, if a customer is purchasing a property for $730,000 with a maximum borrowing capacity of $499,100, the Housing Authority would contribute the remaining $220,714, resulting in the ownership split shown in the Pass result below.

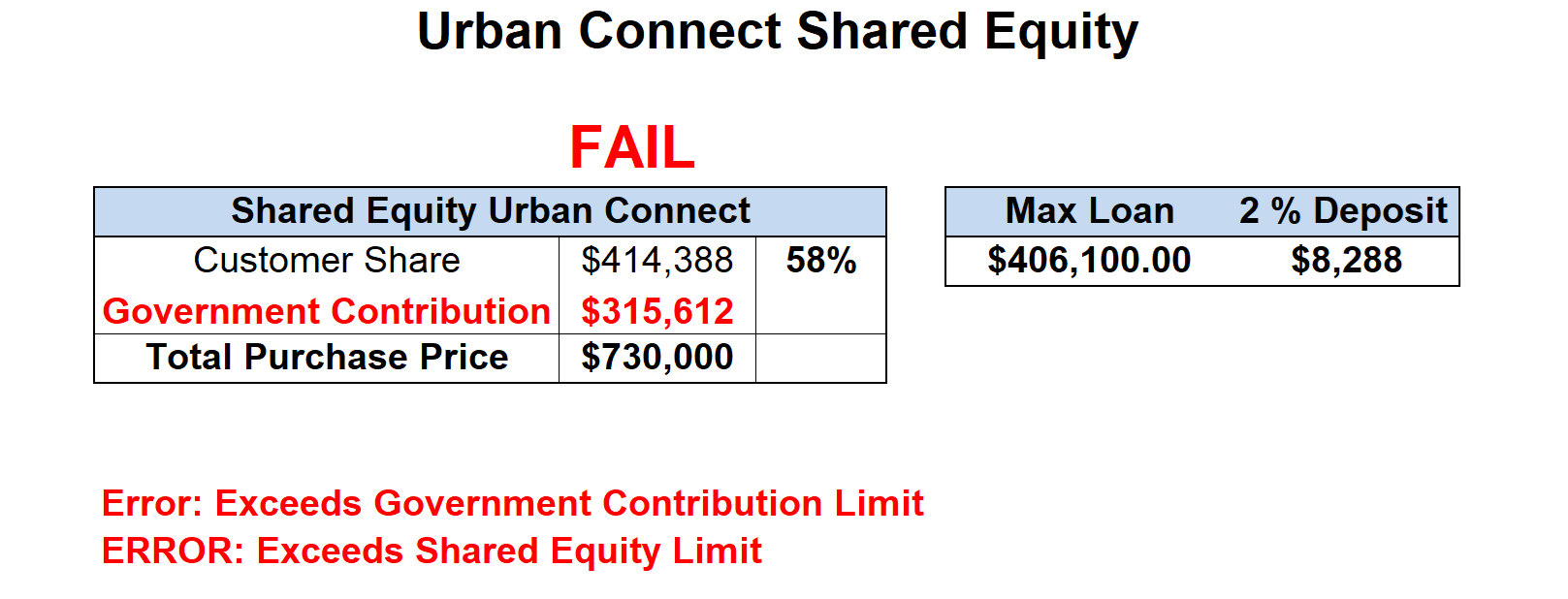

Here is an example where the calculator has failed due to the customer’s contribution is less than the minimum 65%.

-

Q

When should my customer sign their contracts?

A

Advise your customers not to sign any contracts before conditional approval is issued. If the customer signs prior to their application being assessed and their maximum borrowing capacity is different, variations to the contract will need to be issued to reflect the correct ownership split.

-

Q

How do I enter Urban Connect Shared Equity in the Loanapp?

A

- Under New Requirements enter the details of the property your customer is purchasing.

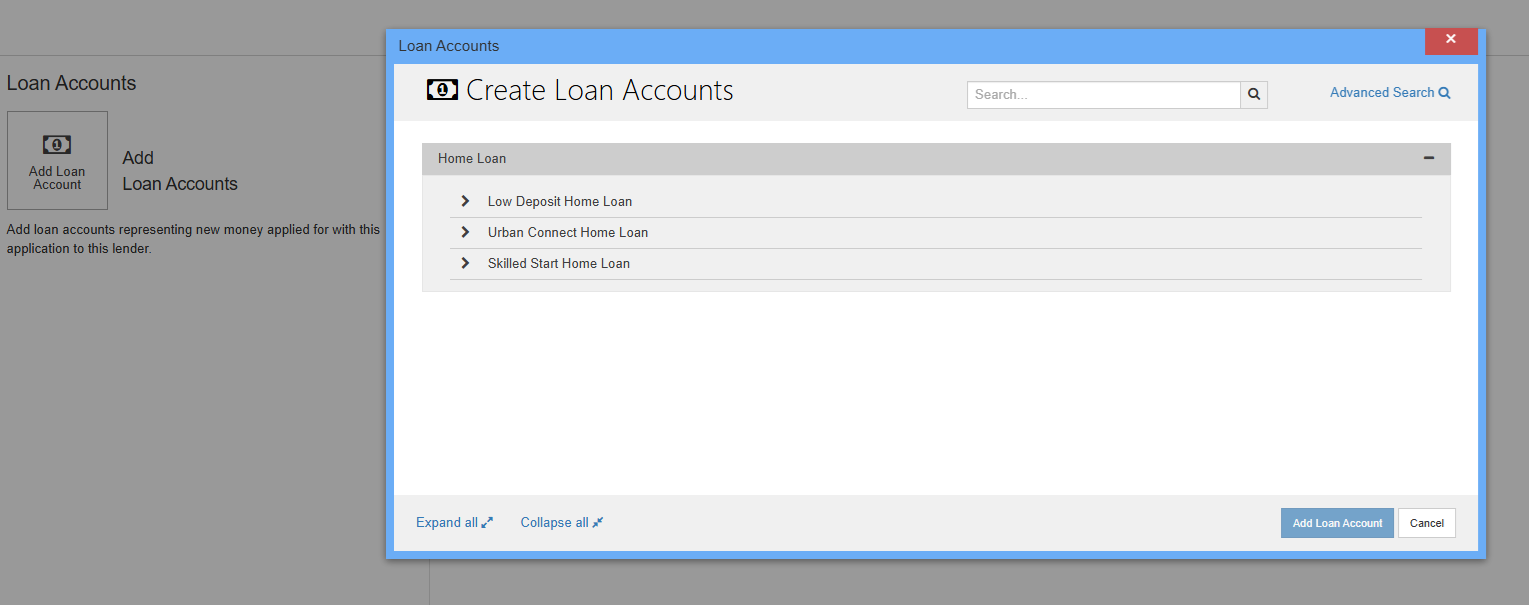

- Under New Loans click on Add Loan Accounts then select Low Deposit Home Loan from the menu (currently there is no option to select Urban Connect Shared Equity).

- Select Low Deposit Home Loan from the list below.

- Under the Summary section, click on the Application Comment tab and enter your submission notes. Include that your customer is applying for the Urban Connect Shared Equity Home Loan.

- Submit the application and upload all supporting documents.

- Once the application is assessed and approved, a conditional approval will be issued advising the customer’s maximum borrowing capacity.

- Save a copy of your offline calculator and include it with your submission.

Note: Maximum property purchase price and income threshold limits for the Urban Connect Shared Equity Home Loan differ from the Low Deposit Home Loan. Loanapp does not provide warnings for these limits, so please refer to the lending policy and use the offline calculator.